The drive against fake invoice rackets has led to the arrest of 215 people, including managing directors of some companies, and the detection of more than 6,600 bogus entities since mid-November, a government official said. The goods and services tax authorities have also registered around 2,200 cases and recovered more than ₹700 crore from these people, the official added. The arrested persons not only include operators of bogus entities issuing fake invoices on a commission basis, but also the end beneficiaries who use such invoices, said the official, who spoke on the condition of anonymity.

The arrested persons also include 81 proprietors, 36 directors or managing directors, 15 partners, three chief executive officers, six chartered accountants, a company secretary, a broker and a GST practitioner, the official added. What has helped in the operation is data analytics and use of artificial intelligence.

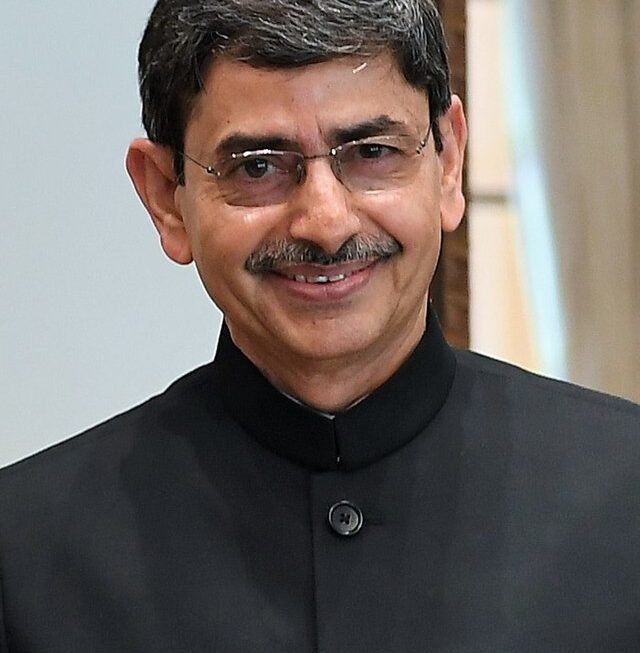

Courtesyg: Google (photo)