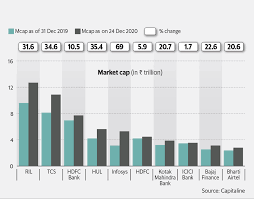

India is set to end the year with five companies valued at more than ₹5 trillion each as foreign investors pumped a record $18.5 billion into Indian stocks in the December quarter, boosting valuations. Hindustan Unilever Ltd and Infosys Ltd entered the ₹5 trillion market capitalization club this year, joining Reliance Industries Ltd, Tata Consultancy Services Ltd and HDFC Bank Ltd. Their shares have risen in the range of 9-68% during the year. Billionaire Mukesh Ambani’s Reliance Industries is the most valuable company with a market value of ₹12.64 trillion, followed by Tata Consultancy at ₹10.91 trillion, HDFC Bank at ₹7.69 trillion, Hindustan Unilever at ₹5.63 trillion and Infosys at ₹5.26 trillion.

Indian stocks plunged more than 20% in March after the nationwide lockdown was announced due to covid; they have not only recovered the losses but also scaled new highs in November and December. The pandemic has created massive opportunities for some businesses. It has created enormous opportunities for pharmaceutical and chemical companies, the technology industry, for offshoring and remotely operating industries, said analysts at HDFC Securities. There are at least three other companies that are within striking distance of entering the exclusive club if the market rally sustains in 2021. They include mortgage lender Housing Development Finance Corp. with a market cap of ₹4.44 trillion, Kotak Mahindra Bank with a market value of ₹3.88 trillion and ICICI Bank at ₹3.54 trillion.

Courtesyg: Google (photo)