The number of income tax returns (ITRs) filed each day for the fiscal year ended March is rising steadily as the 31 December deadline nears. The deadline was extended twice by a total of six months because of the pandemic. Experts said that choosing the correct tax return form is crucial. For individuals, there are four forms-ITR 1 to IT 4. Choosing the wrong one would lead to the tax department treating the form as defective, which will then need to be rectified within a specified time, said Kapil Rana, founder and chairman of Host Books Ltd, an accounting services provider for small businesses. Once filed, the form needs to be e-verified either immediately or within 120 days by sending the signed copy of ITR-V to the department’s central processing centre in Bengaluru. The return can be e-verified even if the Aadhaar number is not linked to the permanent account number (PAN) that is used for filing the return. It can be done using the mobile number linked with the bank account disclosed in the income tax return.

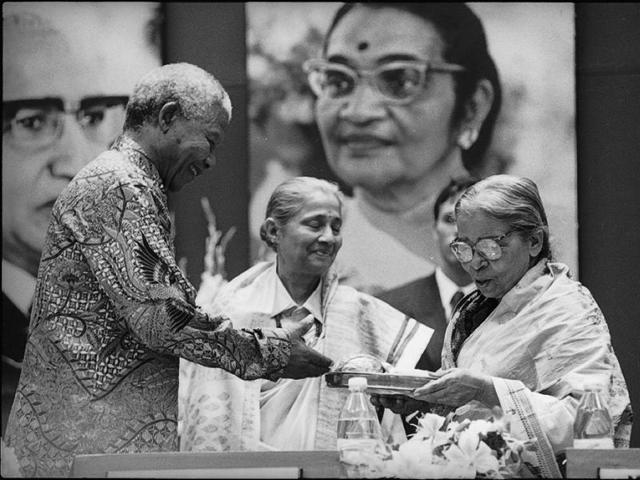

Courtesyg: Google (photo)