The coronavirus led economic recession has once again sparked off a debate over how effective negative interest rates can be in stimulating demand. A new study by economists at Denmark’s central bank finds that the unusual monetary policy tool can encourage more investment and employment in an economy.

Denmark was the first country in the world to bring its key monetary policy interest rate to sub-zero levels and has kept it there for about eight years now. In other words, the Danmarks National bank started charging commercial banks to hold their cash. The idea of the policy was to discourage banks from holding excess reserves and instead invest more in the private sector. As a result of this move, many Danish non-financial firms have faced negative interest rates on their bank deposits for several years. Using microdata covering 45,000 Danish firms over the 2014-2018 period, Kim Abildgren and Andreas Kuchler find that companies with greater exposure to negative deposit rates tend to invest more in hiring as well in fixed capital such as machinery, buildings and commercial vehicles.

After two years of being charged to deposit in banks, an average firm increased its number of employees by about three percentage points more than a similar firm that did not face such negative deposit rates, the authors find. Younger firms, which are typically smaller and in the growth phase, are more likely to respond to negative deposit rates by hiring more employees.

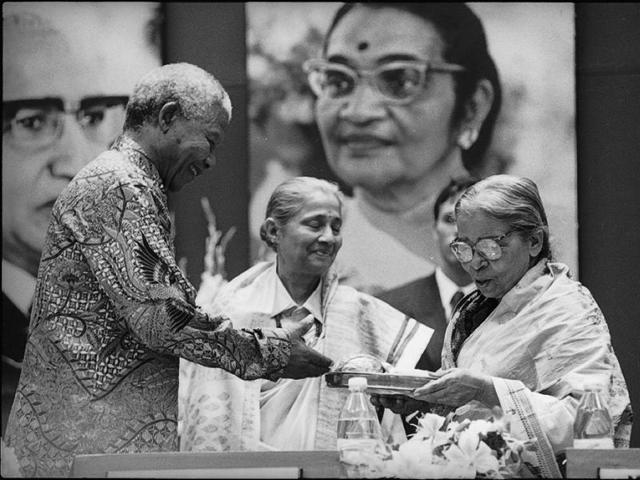

Courtesyg: Google (photo)