Foreign institutional investors (FIIs) have continued their buying spree of Indian equities, lapping up stocks worth more than $2.8 billion so far in December amid optimism about the availability of a Covid-19 vaccine and faster than expected economic recovery. Foreign investors bought $2.81 billion of Indian equities between 1-9 December. In November, they had bought nearly $9.55 billion. So far this year, they have bought $18.92 billion.

The Sensex and Nifty have risen nearly 4.5% each in this period, while in November they advanced 11.4% each. The Sensex and Nifty have climbed nearly 75% since their March lows and nearly 12% each since the start of the year. The continued buying interest by FIIs is because of abundant liquidity, developments on the vaccine front, signs of economic recovery, and expectation of stimulus packages from developed countries, according to market experts. FIIs have been bingeing on Indian equities, with domestic institutional investors (DIIs) having sold nearly ₹16,260 crore in the first eight sessions of December. In November, DIIs sold shares worth ₹48,319 crore.

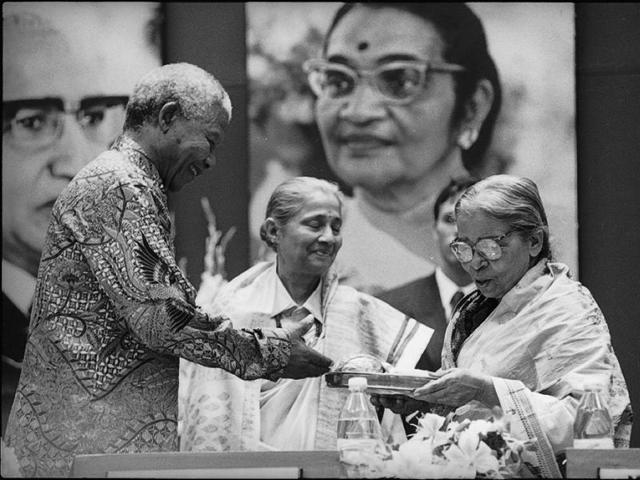

Courtesyg: Google (photo)