Close to ₹18,000 crore of unclaimed deposits were lying with banks in calendar year 2019, up from ₹14,307 crore in 2018, showed the data released by the Reserve Bank of India (RBI). Under central bank rules, deposits are classified as unclaimed when they are not operated for 10 years or more. The figures show that despite improved know-your-customer (KYC) norms, banks are still not able to trace a section of depositors.

Public sector banks have the biggest share in unclaimed deposits at ₹14,971 crore, followed by private sector banks (2,472 crore) and foreign banks at ₹455 crore. Banks transfer deposits unclaimed for 10 years or more to the Depositors Education and Awareness Fund and display a list of such accounts on their websites. In 2015, RBI asked banks to try harder to trace these account holders. Keeping in view public interest, it has been decided that banks should. play a more pro-active role in finding the whereabouts of the account holders of unclaimed deposits and inoperative accounts, it said.

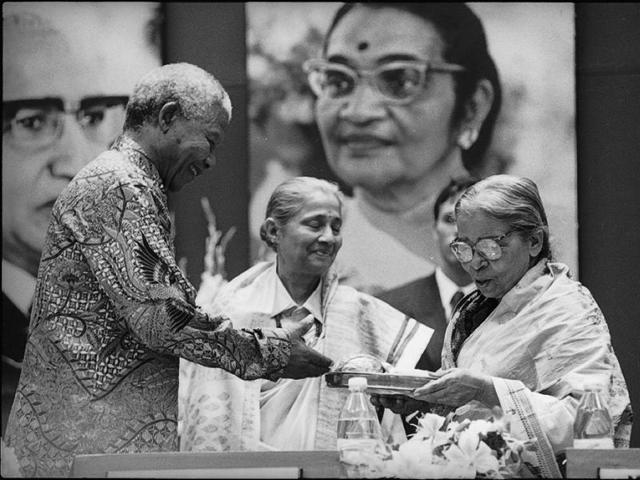

Courtesyg: Google (photo)